TAXATION IN THE TRUMP ERA: REFORMS, REVENUES AND REPERCUSSIONS

Download the Spring Symposium Program

Thursday, May 18

| 8:45-9:00 am |

WELCOME AND INTRODUCTION Victoria Perry, President, National Tax Association |

| 9:00-10:30 am |

TAXATION AND SPENDING: WHAT’S IN STORE AND WHERE WE SHOULD GO FROM HERE (A Panel Discussion) Organizer: Dennis Zimmerman, American Tax Policy Institute |

| 10:30-10:45 am |

BREAK |

| 10:45-12:15 pm |

REDEEM, REPAIR OR REPLACE? HEALTH POLICY AND THE TAX SYSTEM IN 2017 AND BEYOND (A Panel Discussion) Organizer: Janet McCubbin, U.S. Department of the Treasury |

| 12:15-1:45 pm |

LUNCHEON “Tax Reform’s Winners and Losers: Perception and Reality” (SLIDES) |

| 2:00-3:30 pm |

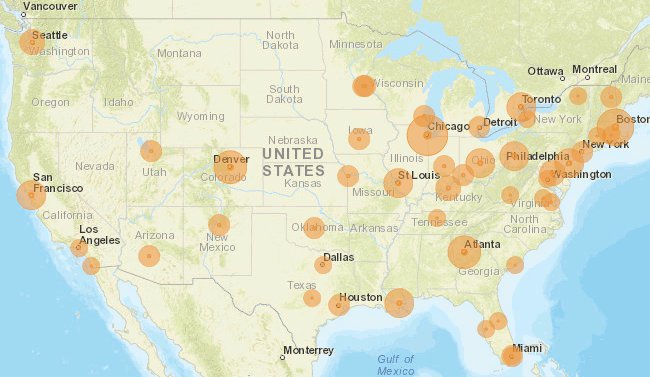

USING THE TAX CODE TO SUPPORT FAMILIES: PAST, CURRENT AND FUTURE POLICY Organizer: Kim Rueben, Urban-Brookings Tax Policy Center (for the American Tax Policy Institute) The EITC over the Great Recession: Who Benefited? (PAPER) (SLIDES) Upward Mobility and State-Level EITCs: Evaluating California’s Earned Income Tax Credit (SLIDES) EITC Claiming at the Household Level in Tax Data Who Benefits from President Trump’s Child Care Proposals? (SLIDES) Discussant: |

| 3:30-3:45 pm |

BREAK |

| 3:45-5:15 pm |

EXPLORING THE DESTINATION-BASED CASH FLOW TAX Organizer: Itai Grinberg, Georgetown University Law Center Destination-Based Cash Flow Taxation (SLIDES) Problems with Destination-Based Corporate Taxes and the Ryan Blueprint (SLIDES) Can a Destination-Based Cash Flow Tax be Compatible with the WTO Commitments of the United States? (SLIDES) Is the Destination-Based Cash Flow Tax Easily Gamed? (SLIDES) |

| 5:15-6:15 pm |

RECEPTION |

Friday, May 19

| 9:00-10:30 am |

ESTIMATING THE MACRODYNAMIC EFFECTS OF TAX REFORM (A Panel Discussion) Organizer: Itai Grinberg, Georgetown University Law Center |

| 10:30-10:45 am |

BREAK |

| 10:45-12:15 pm |

SUBNATIONAL APPROACHES TO CARBON PRICING Organizer: Ian Parry, International Monetary Fund Overly Great Expectations: Disillusion with Cap and Trade in California (SLIDES) Carbon Pricing in the Northeast: Looking Through a Legal Lens (SLIDES) Canada’s Carbon Price Floor (SLIDES) Discussants: |

| 12:15-1:45 pm |

LUNCHEON “States and Tax Reform: Things to Think About” |

| 2:00-3:30 pm |

BEHAVIORAL RESPONSES OF INVESTMENT TO TAX REFORM Organizer: Tom Neubig, Tax Sage Network The Shaky Case for a Business Cash-Flow Tax Accounting for and Perceptions of Expensing (SLIDES) Behavioral Firms and Tax Policy (SLIDES) Discussants: |

![National Tax Association [ National Tax Association ]](https://ntanet.org/wp-content/themes/nta-custom/library/images/nta-whitebg-web-top.svg)

![National Tax Association [ NTA ]](https://ntanet.org/wp-content/themes/nta-custom/library/images/nta-white-logo.svg)